Best State to Incorporate a Company in the USA (2025)

Incorporate a Company in the USA with confidence, choosing the best state to incorporate isn’t just paperwork; it’s a strategic decision that shapes your legal protections and growth opportunities. Picking the right state is vital for your business’s success and compliance.

At We Form Online, our experienced team simplifies this process. Whether it’s Delaware, Nevada, or Wyoming, we help you form a company structured for your goals while staying up to date with legal changes.

Thinking about forming your company in the USA? We Form Online makes it simple — our team handles everything from name registration to compliance setup.

Choose Your Jurisdiction

Why Location Matters

The state you incorporate in affects:

- Legal framework: owner and shareholder protection

- State taxes: income, franchise, and sales tax

- Privacy and reporting: who gets to see your info

- Formation and yearly compliance costs

- Business-friendly policies and speed

A smart choice means fewer headaches, lower costs, and stronger asset protection.

Top US States Overview-Incorporate a Company in the USA

While you can incorporate anywhere, three states lead the pack for business advantages:

- Delaware (investor trust, legal clarity)

- Nevada (privacy, tax perks)

- Wyoming (affordability, asset protection)

Your home state is often simplest for local businesses.

Delaware Incorporation: The Gold Standard

Delaware incorporation is famous with investors and high-growth startups. Key facts:

- Specialized Court of Chancery—which issues over 1,000 corporate decisions a year see government stats, 2025

- Flexible rules for custom ownership and controls

- Strong director/officer protections

- No corporate income tax on out-of-state business

- Fast filing via state portal

- Shareholder privacy

We Form Online handles everything: name checks, bylaws, stock setup, and more—using proven Delaware processes.

Nevada Business Benefits

Nevada business benefits include powerful privacy and tax neutrality:

- No state corporate income or franchise tax

- Confidential owner info

- Flexible governance

- Strong asset protection

- No state-IRS info sharing

Nevada is popular for holding companies and startups valuing discretion.

Wyoming LLC Advantages

A Wyoming LLC is unmatched for cost-effective entity setup:

- Low fees, few ongoing requirements

- No state income/franchise tax

- Robust privacy and asset protection

- Quick filings via state online systems

We Form Online makes Wyoming LLC formation easy, from filing to EIN application.

Small Business Incorporation: Home State

For businesses operating locally, small business incorporation in your home state is often best:

- No extra foreign registration fees

- Easiest tax and compliance

- Lower agent and filing costs

- Simplified banking

Our experts help you pick the right fit based on your business plan.

Holding Company States: Best Options

Holding company states like Delaware, Nevada, and Wyoming each serve unique needs:

- Delaware: suited for complex, investor-driven structures

- Nevada & Wyoming: best for privacy and simple asset holding

Lean on We Form Online to pick and set up the best fit for your holding company.

Cost Comparisons

| State | Formation Fees | Annual Fees & Reports | Corporate Income Tax | Privacy Level | Best For |

|---|---|---|---|---|---|

| Delaware | Moderate | Moderate | None if no in-state biz | Moderate | High-growth, VC-backed firms |

| Nevada | Moderate | Higher | None | High | Privacy-first startups |

| Wyoming | Low | Low | None | High | SMBs, cost-conscious owners |

| Home State | Varies | Varies | Varies | Varies | Local or retail businesses |

Contact our team for a detailed cost breakdown personalized to your needs.

Legal Protections by State

Every state offers some level of owner and director liability protection, but strength and process differ:

- Delaware: rapid court process via Court of Chancery

- Nevada/Wyoming: robust privacy, streamlined dispute handling

We’ve incorporated in both Delaware and Nevada. Our team has dealt directly with official forms and agents in all three states.

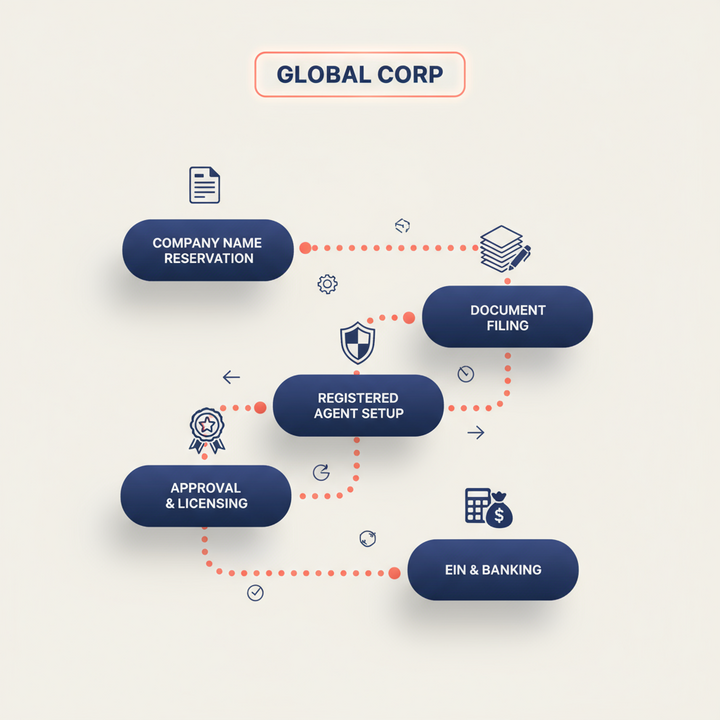

Process Steps: How Incorporation Works

- Reserve your company name online (usually 1–3 business days)

- Prepare and file Articles of Incorporation (plus bylaws/operating agreement)

- Appoint a registered agent (same day setup with our platform)

- Get state approval (1–3 days typical)

- Apply for your EIN using the IRS portal (irs.gov)

We provide official state screenshot guides so you see exactly what’s required at every step.

Incorporation Timelines by State

| Step | Delaware | Nevada | Wyoming | Home State |

|---|---|---|---|---|

| Name Reservation | 1-2 days | 1-3 days | 1-2 days | 1-5 days |

| Preparation & Filing Docs | 1-2 days | 1-2 days | 1-2 days | Varies |

| Registered Agent Setup | Same day | Same day | Same day | Same day |

| Government Approval | 1-3 days | 1-3 days | 1-2 days | Varies |

| EIN Application | 1-3 days | 1-3 days | 1-3 days | Varies |

Thinking about forming in Delaware, Nevada, or Wyoming? We Form Online streamlines every step and provides dedicated support from registration through compliance maintenance. Learn more about global incorporation options.

Common Pitfalls to Avoid

- Assuming out-of-state incorporation is best without checking home-state laws

- Not budgeting for double-registration

- Overlooking compliance renewals

- Choosing privacy states for the wrong entity structure

Our team helps you sidestep these risks—backed by experience and direct state collaborations.

Frequently Asked Questions (FAQ)

- What’s the absolute best state to incorporate a company in 2025?It depends! Delaware for fast-growing and VC-backed businesses; Wyoming for low cost/LLCs; Nevada for privacy; often your home state for local businesses.

- Is Delaware incorporation only for big companies?No—startups of all sizes benefit from Delaware’s clear legal rules, even as solo founders.

- How fast can I get my company started?Most states process online incorporations in 1–3 business days (see comparison table above).

- Will I need a local address?Not always. We Form Online acts as your registered agent remotely in Delaware, Nevada, and Wyoming.

- Do I need a US Social Security Number?No! Foreign founders can incorporate with passport/ID; we guide you on every step.

- Can I form a holding company for my assets?Yes, all three states support holding companies with privacy and asset protection features.

- Does incorporation protect me from lawsuits?Yes, but only if you follow compliance and corporate formalities—our service helps you stay protected.

- What about forming in Texas, Florida, or California?These are good for businesses operating mainly there. For nationwide or remote businesses, Delaware, Nevada, and Wyoming are usually better.

- How much does it cost to maintain an entity long-term?Varies by state, but our experts provide transparent estimates upfront.

- How do I open a bank account after incorporating?We connect you with leading solutions and guide you on requirements.

Short Glossary

- Registered Agent: A service provider who accepts legal docs on behalf of your company

- Articles of Incorporation/Organization: The official company formation paperwork

- Operating Agreement: Internal rules for running an LLC

- Franchise Tax: Ongoing state tax for entities incorporated in certain states

- Holding Company: An entity created to own stock or assets in other companies

Ready to incorporate?

Start your company formation with We Form Online today. Visit our website or contact our team for a truly seamless launch experience and expert guidance.

Comprehensive state comparison for businesses (2025) (external, comprehensive, 2025 data)

Schedule a 15 minutes introduction call with our experts to meet your exact business needs

Schedule a Free Consultation Today