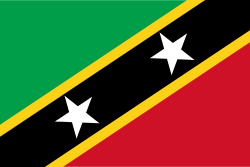

Saint Kitts and Nevis

Company Formation

Starting at €4200

What's included for 4200€ :

What’s Included:

- Incorporation of company

- Governmental fees for first year

- Free Online Platform

- Scanned corporate documents

- Registered Address

Company formation

Company formation

If you’re thinking about setting up an international company, Nevis is definitely worth considering due to its numerous advantages and positive business environment. Nevis offers a number of benefits for those looking to set up an international company, including tax exemptions, confidentiality of business information, ease of company formation and management, political stability, and access to global markets.

Requirements:

- Business Structure: You will need to decide on the structure of your business, whether it will be a Limited Liability Company (LLC), Corporation, or Partnership.

- Name for Your Company: The name of your company must not be already in use by another company on Nevis.

- Registered Agent: You will need to appoint a registered agent who will be responsible for receiving legal notices and official correspondence on behalf of your company.

- Obtaining Necessary Permits: Depending on the nature of your business, you may need to obtain additional permits or licenses from the relevant authorities.

Required personal documents:

- Valid Passport: You will need to provide a valid passport as proof of your identity.

- Proof of Address: You may be required to provide proof of your address, such as a recent utility bill or bank statement.

- Professional References: Depending on the nature of your business, you may be required to provide professional references from individuals or organizations in your industry.

Advantages of setting up an Nevis company:

- Tax benefits: Nevis is known for its favorable tax environment. International companies established on Nevis are exempt from income tax, capital gains tax, and withholding tax.

- Privacy and confidentiality: Nevis offers strict privacy laws that protect the identities of company owners and directors. Nevis companies are not required to disclose the identities of their shareholders, directors, or officers to the public.

- Loyal regulations: Nevis has a favorable regulatory environment with laws that protect investors and encourage foreign investment.

- Asset protection: Nevis offers strong asset protection laws that make it difficult for creditors to seize assets owned by Nevis companies. This can be especially beneficial for individuals who wish to protect their personal assets from potential lawsuits or creditor claims.

- Easy setup and maintenance: Setting up and maintaining a Nevis company is relatively simple and cost-effective. Nevis companies can be formed quickly and require minimal ongoing maintenance.

- Geographic flexibility: Nevis companies can be managed and operated from anywhere in the world. This makes it easy for business owners to establish an international presence and take advantage of global opportunities.

- Advanced banking system: Nevis also has a well-developed financial infrastructure with modern banking systems, reliable telecommunication networks, and efficient legal frameworks to facilitate business operations

- Local presence not required: Nevis does not require companies to have physical offices or employees on the island, making it an attractive option for those seeking a low-cost international business presence.

Required reports

Required reports

Companies registered in Nevis are required to file certain reports and maintain accurate records. The specific requirements may vary depending on the type of business structure and the nature of the business, but in general, the following reports and records are required:

- Annual Returns: All Nevis companies are required to file an annual return with the Nevis Companies Registry. This report includes information about the company’s directors, shareholders, and registered office.

- Financial Statements: Nevis companies are required to maintain accurate financial records and prepare financial statements on an annual basis. These statements must be audited by a licensed accountant or auditor and submitted to the Nevis Inland Revenue Department.

- Tax Returns: Nevis companies are required to file tax returns with the Nevis Inland Revenue Department on an annual basis. The tax return must include a complete statement of the company’s income and expenses for the year.

It is important to note that failure to comply with these reporting requirements can result in penalties and fines, so it is important to stay up to date with all reporting obligations. In We Form Online we can assist with all required reports and maintenance.

Registered Address

Registered Address

Companies registered in Nevis are required to have a registered office. The registered office is the official address of the company in Nevis and is used for official correspondence and legal notices. The registered office must be a physical address in Nevis and cannot be a post office box or similar virtual address.

The registered office is where the company’s statutory records, such as the register of directors and register of members are kept and is where the company’s books and records are available for inspection by government authorities. We Form Online will be glad to assist you with provision of Registered address on Nevis, please feel free to contact us.

VAT registration

VAT registration

Companies registered in Nevis are required to apply for a Value Added Tax (VAT) number if they meet certain criteria. Specifically, companies that engage in taxable activities in Nevis and have an annual turnover of $60,000 or more are required to register for VAT.

Once a company is registered for VAT, it must charge VAT on all taxable supplies made in Nevis and must file regular VAT returns with the Nevis Inland Revenue Department. The VAT returns must include a complete statement of all sales and purchases made during the period, along with the amount of VAT charged and paid.

It is important to note that failure to comply with the VAT requirements can result in penalties and fines, so it is important to ensure that all VAT obligations are met in a timely and accurate manner. It is recommended that you consult with a local accountant or business consultant to determine if your Nevis company is required to register for VAT and to assist with the VAT registration process if necessary.