Company Formation in Bulgaria: Complete 2025 Guide

Company Formation in Bulgaria is an excellent choice for fast, affordable EU business setup with full remote options available.

Bulgaria offers low taxes, minimal capital requirements, and seamless access to the European single market, making it highly attractive for entrepreneurs worldwide.

Thinking about company formation in Bulgaria? We Form Online makes it simple — our team handles everything from name registration to compliance setup.

Choose Your Jurisdiction

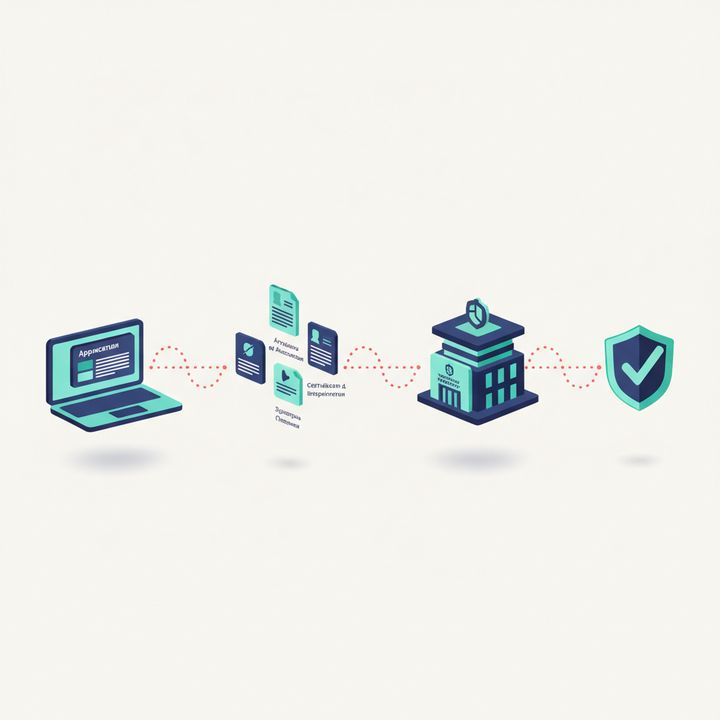

Company Formation in Bulgaria: Step‑by‑Step Process

The sequence below reflects how we actually register companies for clients (50+ UK clients in 2023–2024 alone). We prepare and submit your file through the Bulgarian Commercial Register portal and track it until the electronic certificate is issued.

- Planning and name check

– Confirm shareholders/managers, share split, and registered office.

– We check the name and Latin/Cyrillic spelling to avoid rejections. - Document pack preparation

– Articles of Association (EOOD/OOD) or Founding Act.

– UBO declaration and manager consent statements.

– Notarized specimen signature(s) of the manager(s).

– Certified passport/ID copies; apostille where applicable.

– Registered office proof. - Capital deposit

– Open a temporary bank account and deposit the share capital (as little as 2 BGN for LTDs).

– Bank certificate confirming the paid‑in capital is included in your file. - Filing with the Commercial Register

– We submit the application electronically, pay state fees, and monitor examiner notes.

– Typical approval window: 3–7 business days once the file is complete. - Post‑registration

– Issuance of your EIK/BULSTAT number.

– Optional VAT registration (mandatory if turnover exceeds BGN 100,000 over the last 12 months).

– Accounting setup and monthly bookkeeping cadence.

Pro tip: Keep digital copies of all apostilled documents. The Register may request clarifications; having scans ready speeds up responses by a day or two.

Explore our end‑to‑end company startup service to get a tailored plan for your situation.

Choosing the Right Legal Entity (OOD/EOOD and more)

Most foreign founders pick a Limited Liability Company—OOD (multi‑owner) or EOOD (single owner). It balances simplicity, protection, and cost. Here’s a quick comparison to help you decide.

| Structure | Liability | Min. Capital | Best for | Notes |

|---|---|---|---|---|

| EOOD/OOD (LTD) | Limited to company assets | 2 BGN | SMEs, international founders | Easiest to run; manager can be non‑resident. |

| AD/EAD (JSC) | Limited | 50,000 BGN | Larger ventures, fundraising | Board structure; higher reporting. |

| ET (Sole trader) | Unlimited personal | None | Micro businesses | Personal risk; not common for foreign owners. |

| SD/KD (Partnerships) | Unlimited/mixed | None | Small partnerships | Partners share liability. |

| Branch/Rep. Office | Parent liable | N/A | Market entry by foreign companies | No separate legal personality (branch). |

Legal and Tax Advantages That Make Bulgaria Stand Out

- Corporate tax: Flat 10%, among the lowest in the EU.

- Dividend tax: Only 5%.

- Regional incentives: Potential tax exemptions for businesses in disadvantaged areas creating jobs.

- R&D credits: Enhanced deductions for eligible research expenditures.

- Startup perks: Special tax relief for tech and innovation-driven companies.

- Double taxation treaties: Broad network to ease tax burdens for foreign investors.

- EU single market access: Smooth cross-border trade and VAT compliance.

Quick summary: Bulgaria keeps your tax bill low and offers tailored perks to help your business grow.

Why Remote Company Formation in Bulgaria Works for You

- Entirely remote: No travel needed; notarizations and filings done digitally.

- No residency demands: Foreign owners and directors aren’t required to live in Bulgaria.

- Fast registration: Just a few days after submitting complete documents.

- Reduced costs: Save on travel and administrative fuss.

- Local expert support: Access trusted agents, accountants, and legal pros who handle the details for you.

What this means: Bulgaria is fully set up for international founders to start, run, and grow companies from anywhere.

Bulgaria vs. Other EU Countries: How It Compares

| Feature | Bulgaria | Western EU Average |

|---|---|---|

| Corporate Tax Rate | 10% flat | Typically 15–30% |

| Minimum Capital | 2 BGN (~€1) | €1,000 to €25,000+ |

| Registration Time | 3–14 days | Often 2–8 weeks |

| Cost of Registration | €800–€1,500 | Usually €1,500+ up to €5,000+ |

| Remote Incorporation | Fully possible | Increasingly possible, sometimes complex |

| VAT Threshold | ~BGN 100,000 (€51,000) | Often lower (around €10,000–€50,000) |

| Bureaucracy Level | Low to moderate | Moderate to high (varies) |

| EU Market Access | Full | Full |

| Business Language | Bulgarian (translation needed) | Native languages vary |

In essence: Bulgaria offers unbeatable tax rates, speed, and affordability versus many Western EU countries, ideal for startups and SMEs eyeing EU markets.

Case Study: How a UK Resident Sets up a Bulgarian Company Remotely

Imagine you’re a UK entrepreneur ready to expand internationally. Here’s how it works:

- Reserve your company name and prepare incorporation docs certified and apostilled in the UK.

- Notarize signatures and translate where needed.

- Open a Bulgarian bank account remotely or with agent assistance; deposit minimum capital.

- Submit all paperwork through a provider like We Form Online, which handles registration end-to-end.

- Within 7–14 days, receive company registration and Bulstat tax ID.

- Use virtual office services for your mandatory Bulgarian address.

- Manage your Bulgarian company entirely from the UK—no residency required.

Takeaway: Post-Brexit, Bulgaria remains a welcoming, streamlined destination for UK entrepreneurs.

Handy Checklist for UK Residents Incorporating in Bulgaria

- Decide: OOD (multiple owners) or EOOD (sole owner).

- Verify and reserve your company name with Bulgarian Trade Register.

- Prepare Articles of Association or Founding Act.

- Collect certified, apostilled passports and IDs.

- Notarize directors’ specimen signatures.

- Secure a Bulgarian registered office (virtual office works).

- Open a corporate bank account and deposit 2 BGN minimum.

- Submit incorporation paperwork to Commercial Register via trusted service.

- Obtain Bulgarian tax ID (Bulstat).

- Register for VAT if turnover may exceed BGN 100,000 (~€51,000).

- Set up accounting and compliance support for ongoing operations.

Download the full checklist and detailed process for company formation in Bulgaria here

Ready to Launch Your Bulgarian Company with Expert Support?

Bulgaria’s low taxes, fast process, and EU market access make it a smart spot for entrepreneurs worldwide—especially UK residents. At We Form Online, we take the hassle out of registration with tailored remote services and specialist guidance every step of the way.

Start your company formation in Bulgaria journey with us today—visit weformonline.com or contact our experts for a personalized consultation.

Schedule a 15 minutes introduction call with our experts to meet your exact business needs

Schedule a Free Consultation Today