Crypto Authorization in Costa Rica: 2025 Definitive Guide

Crypto authorization in Costa Rica is essential for anyone looking to start a compliant digital asset business.

Costa Rica is carving out a unique space in the digital asset world. For entrepreneurs, the promise of a tropical paradise combined with a hands-off regulatory approach is tantalizing. But what does it really take to operate a compliant crypto business there? This guide provides a clear roadmap for obtaining crypto authorization in Costa Rica, covering everything from the current legal landscape to future trends.

Thinking about forming your company in Costa Rica? We Form Online makes it simple — our team handles everything from name registration to compliance setup.

Choose Your Jurisdiction

The Regulatory Framework for Cryptocurrency in Costa Rica

Costa Rica manages digital assets through its existing financial and corporate laws rather than a standalone crypto-specific rulebook. This means oversight is distributed among several key government bodies, each with a distinct role.

- SUGEF (Superintendencia General de Entidades Financieras): As the financial superintendent, SUGEF is the primary enforcer of AML/CFT (Anti-Money Laundering/Counter-Financing of Terrorism) compliance. Any business dealing with virtual assets must have policies in place that meet SUGEF’s standards.

- Central Bank of Costa Rica (BCCR): The BCCR monitors the financial system and has clarified that while crypto is not legal tender, it is not prohibited. The bank maintains a watchful but non-interventionist posture.

- SUGEVAL (Superintendencia General de Valores): If a crypto asset has the characteristics of a security (e.g., offering investment returns), it falls under the jurisdiction of the securities superintendent, SUGEVAL.

- Ministry of Finance: This body oversees all tax-related matters, including how income, capital gains, and potential value-added taxes apply to crypto transactions.

This decentralized approach makes the regulatory framework for cryptocurrency in Costa Rica both adaptable and complex. Businesses must understand their obligations to each entity to ensure full compliance.

| Feature | Current Status (2025) | Proposed Future (Under Bills 22.837 & 23.415) |

|---|---|---|

| Crypto License | Not required. Operate under general business law. | Mandatory registration for Virtual Asset Service Providers (VASPs). |

| Primary Regulator | SUGEF for AML/CFT compliance. | SUGEF supervision formalized and expanded for all VASPs. |

| Legal Tender | No. Crypto is not official currency. | Remains unchanged. |

| AML/CFT Rules | Mandatory adherence to existing financial laws. | Stricter, VASP-specific AML/CFT protocols enforced by SUGEF. |

| Taxation | Governed by general income and capital gains tax rules. | Bill 23.415 aims to provide clearer tax definitions. |

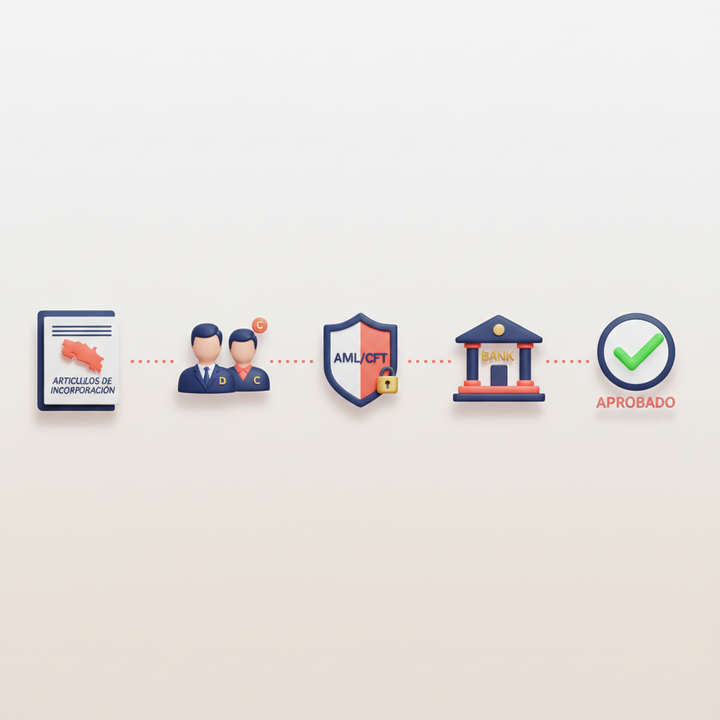

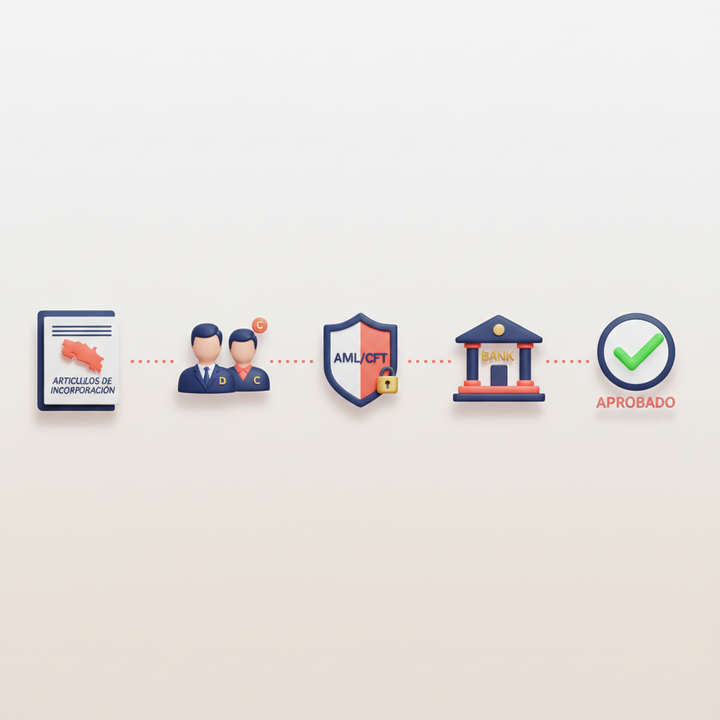

How to Secure Your Crypto Authorization in Costa Rica

While there isn’t a single ‘crypto license,’ achieving authorization means establishing a fully compliant legal entity. Our team at We Form Online has streamlined this into a clear, five-step process based on our direct experience setting up crypto companies in the jurisdiction.

Step 1: Incorporate Your Costa Rican Company

The foundation of your operation is a legal entity. Most crypto businesses choose a Limited Liability Company (SRL) or a Corporation (SA). Key benefits include 100% foreign ownership and no minimum capital requirement. Our team handles the entire registration with the National Registry, from drafting the articles of association to submitting the required Form E1 for legal entity registration.

Step 2: Appoint Key Personnel

Your company must have at least one director, a shareholder, and a compliance officer. These roles can be filled by individuals of any nationality. The compliance officer is particularly crucial for a crypto business, as they will be responsible for designing and overseeing your AML program.

Step 3: Establish a Local Presence

A registered office address in Costa Rica is mandatory. While a physical office isn’t always necessary, a legal address is required for official correspondence. Opening a corporate bank account is another critical step, though it can be challenging for crypto businesses due to the risk-averse nature of some banks. We Form Online helps navigate this by leveraging our relationships with crypto-friendly financial institutions.

Step 4: Implement a Robust AML/CFT Program

This is non-negotiable. Before you can even consider launching, you must develop and implement a comprehensive AML/CFT policy. This includes customer due diligence (KYC), transaction monitoring, and reporting suspicious activities to SUGEF. As one of our lead Costa Rican legal experts notes, “Proving your commitment to AML compliance from day one is the single most important factor for long-term success and positive banking relationships in Costa Rica.”

Step 5: Prepare for VASP Registration

With new legislation on the horizon, proactive businesses should prepare for mandatory VASP registration under SUGEF. This involves documenting your business model, security protocols, and AML procedures. Aligning your operations with the 2023 guidelines from the Financial Action Task Force (FATF) is the best way to future-proof your business.

Navigating the National Registry and SUGEF requirements can be complex. We Form Online streamlines this entire process, ensuring your Costa Rica company formation is set up for crypto success from day one.

Taxation Policies Related to Cryptocurrency in Costa Rica

Costa Rica’s territorial tax system is a major draw for international entrepreneurs. Simply put, only income generated from activities within Costa Rica is subject to tax. Foreign-sourced income is generally tax-exempt. This has significant implications for crypto businesses.

- Corporate Income Tax: If your crypto exchange, consultancy, or service generates revenue from customers within Costa Rica, that income is subject to corporate income tax (up to 30%).

- Capital Gains Tax: A 15% tax applies to capital gains from the sale of assets. How this applies to crypto depends on whether the assets are held as part of normal business activity or as a long-term investment.

- Value-Added Tax (VAT): The application of VAT to crypto services remains a grey area. Currently, most crypto transactions are not subject to VAT, but this could change as regulations mature.

- Global Operations: If your Costa Rican company serves clients globally and generates its revenue outside the country, that income is typically not taxed in Costa Rica. This makes it an ideal hub for international crypto operations.

The key takeaway on taxation policies related to cryptocurrency in Costa Rica is the importance of meticulous bookkeeping. You must clearly distinguish between local and foreign income streams.

Common Pitfalls and Legal Implications of Crypto Transactions in Costa Rica

While the environment is favorable, new entrepreneurs can face challenges. Awareness is key to avoiding them.

- Banking Hurdles: Despite crypto’s legal status, some traditional banks remain hesitant to service crypto companies. Success often depends on presenting a professional business plan and a rock-solid AML policy.

- Misclassifying Tokens: Accidentally issuing a token that could be classified as a security without approval from SUGEVAL can lead to serious legal trouble. Always analyze your token’s function before launch.

- Ambiguous Contracts: Since crypto is not legal tender, all contracts involving digital asset payments must be drafted with extreme precision, specifying exchange rates and settlement terms clearly.

- Ignoring Data Privacy: As a business handling client information, you are subject to Costa Rica’s data protection laws. Ensure your cybersecurity and data handling protocols are robust.

Understanding the legal implications of crypto transactions in Costa Rica is critical. Our experts at We Form Online provide guidance on these nuances, helping you sidestep common mistakes.

Glossary of Key Terms

- VASP (Virtual Asset Service Provider): A business that facilitates virtual asset services, such as exchanges, wallet providers, or crypto payment processors.

- SUGEF (Superintendencia General de Entidades Financieras): The financial superintendent responsible for overseeing AML/CFT compliance.

- BCCR (Banco Central de Costa Rica): The Central Bank of Costa Rica, which monitors the country’s financial stability.

- Territorial Taxation: A system where taxes are levied only on income generated within a country’s borders.

- AML/CFT: Anti-Money Laundering and Counter-Financing of Terrorism; a set of laws and procedures designed to prevent financial crimes.

Frequently Asked Questions (FAQ)

1. Is cryptocurrency legal in Costa Rica?

Yes, cryptocurrency is legal to own, trade, and use for transactions. However, it is not considered official legal tender.

2. Do I need a special license to start a crypto business in Costa Rica?

No, there is currently no specific ‘crypto license.’ You must register a standard legal entity and comply with all applicable financial regulations, especially AML/CFT rules.

3. What is the main advantage of Costa Rica for a crypto company?

Its territorial tax system is a primary advantage. Income generated from outside Costa Rica is generally not taxed, making it an attractive jurisdiction for global crypto businesses.

4. What are the biggest challenges for a new crypto business in Costa Rica?

Opening a corporate bank account can be difficult, and navigating the evolving regulatory landscape requires diligence. A strong AML policy is essential to overcoming banking hurdles.

5. What is a VASP, and will I need to register as one?

A VASP is a Virtual Asset Service Provider. Under proposed new laws, businesses like crypto exchanges, custody providers, and certain wallet services will likely be required to register as VASPs with SUGEF.

6. Can a foreigner own 100% of a crypto company in Costa Rica?

Yes, Costa Rican law allows for 100% foreign ownership of companies, and directors can be of any nationality.

7. How is crypto income taxed?

Income from crypto activities generated within Costa Rica is subject to corporate income tax. Capital gains may also be taxed. Income from foreign sources is generally exempt.

8. What does SUGEF do?

SUGEF is Costa Rica’s financial superintendent, responsible for ensuring that financial institutions and certain other businesses (including crypto companies) comply with anti-money laundering regulations.

Why Choose We Form Online?

Launching a crypto venture in a new jurisdiction requires more than just filling out forms—it demands expert navigation of an evolving legal landscape. At We Form Online, we provide end-to-end support for entrepreneurs entering the Costa Rican market.

- Expert Incorporation: We handle every step of company registration, ensuring all legal and compliance requirements are met from day one.

- Regulatory Insight: Our team monitors legislative changes in real-time, helping you stay ahead of new requirements like VASP registration.

- Banking Assistance: We leverage our network to help you open corporate bank accounts with institutions that understand the crypto industry.

- Global Reach: With services across a wide range of crypto-friendly countries, we can help you build the ideal corporate structure for your international business. Explore our all jurisdictions to see how we can support your growth.

Ready to launch your business? Start your company formation with We Form Online today. Visit our website or contact our team for a personalized consultation.

Schedule a 15 minutes introduction call with our experts to meet your exact business needs

Schedule a Free Consultation Today