LLC vs LTD vs Corporation: Key Differences for Entrepreneurs

When you’re starting a new business, choosing the right legal structure can be as crucial as your business idea itself. The decision can affect everything from taxes and liability to fundraising and management. Three common structures are LLCs, LTDs, and Corporations — but how do you know which one fits your needs?

In this guide, we’ll explore the LLC vs LTD difference, examine the difference between LLC and LTD, and help you understand the limited company vs corporation comparison. Whether you’re launching in the US, UK, or globally, this article offers insights to help you make the best decision.

What Are LLCs, LTDs, and Corporations?

LLC (Limited Liability Company)

An LLC is a US-based structure that combines elements of partnerships and corporations. It provides liability protection to its owners (called members) while offering flexible taxation and management.

LTD (Private Limited Company)

LTDs are commonly used in the UK and other Commonwealth countries. Similar to LLCs, they provide limited liability but follow different legal, tax, and governance structures.

Corporation (Inc or Corp)

Corporations are more formal entities often used by larger businesses in the US. They are separate legal entities owned by shareholders and managed by a board of directors. They can be C-Corps or S-Corps, each with different tax treatments.

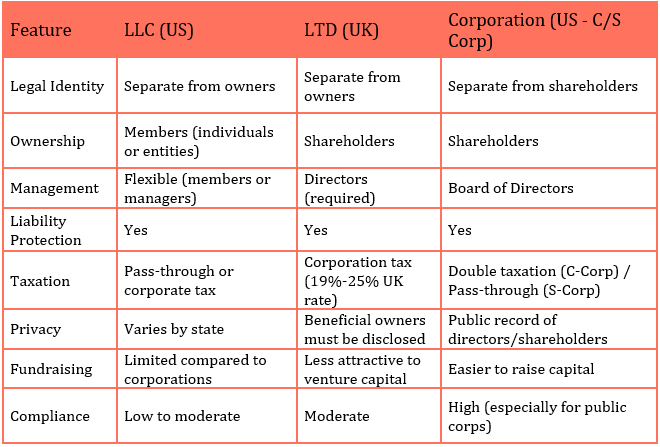

Key Differences: LLC vs LTD vs Corporation

Here’s a breakdown of the main differences to help entrepreneurs quickly understand the options:

Comparison Table: LLC vs LTD vs Corporation

Jurisdiction Matters: UK LTD vs US LLC

The UK LTD vs US LLC debate is common among global entrepreneurs. While both offer liability protection and a formal structure, they differ in regulatory frameworks.

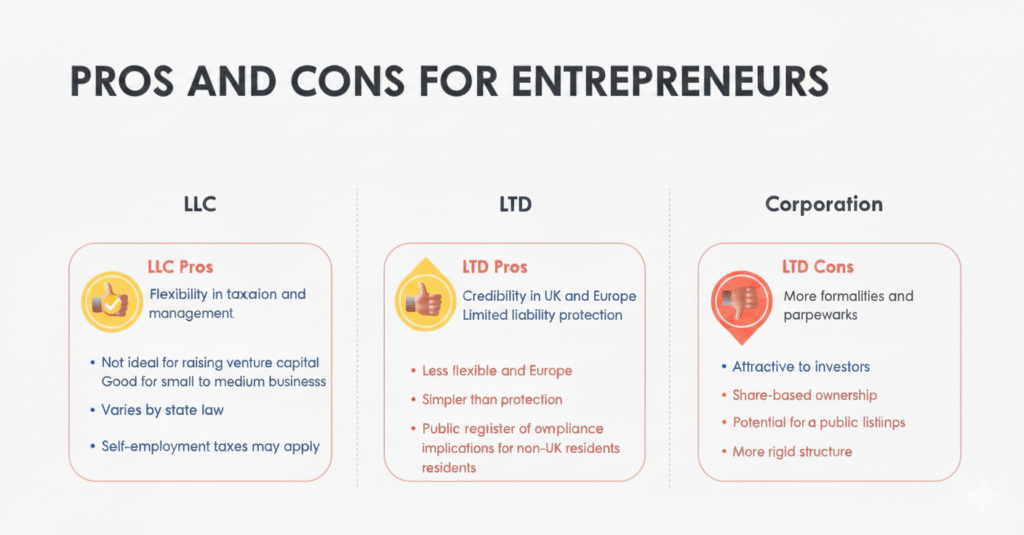

UK LTD Pros:

- Familiar to UK investors

- Straightforward for local taxation

- Minimal management overhead for small businesses

US LLC Pros:

- Tax flexibility (can choose to be taxed as partnership or corporation)

- Simplified filing in many states

- More control over ownership structure

If you’re operating internationally, it’s important to consider where your customers, partners, and investors are based. A US LLC might not be ideal if you’re targeting UK markets or vice versa.

How to Choose the Right Legal Structure

Ask yourself these key questions:

Where will your business operate?

Are you planning to raise investment?

Do you prefer flexibility or formality?

What are your tax considerations?

Quick Advice:

Go with an LLC if you want flexibility, low compliance, and tax options

Choose an LTD if you’re operating in the UK and want credibility and limited liability

Opt for a Corporation if you’re planning to scale, raise venture capital, or go public

WeFormOnline Can Help

Choosing a legal structure can be overwhelming — but it doesn’t have to be. At WeFormOnline, we simplify the company formation process, whether you’re looking to start a US LLC, register a UK LTD, or incorporate a C-Corp.

✅ Instant Online Formation

✅ Jurisdiction Guidance

✅ Banking and Compliance Support

Explore our Company Formation Guide to get started today.

Final Thoughts

The decision between an LLC vs LTD vs Corporation isn’t just a legal formality — it’s a strategic choice that can shape your business’s success. From tax implications to ownership structure and investor appeal, each entity type comes with unique advantages and trade-offs.

By understanding the difference between LLC and LTD, comparing a limited company vs corporation, and identifying your priorities, you’ll be well-equipped to choose the best structure for your entrepreneurial journey.

Schedule a 15 minutes introduction call with our experts to meet your exact business needs