When “Trust” Is Mandatory

What does trust mean?

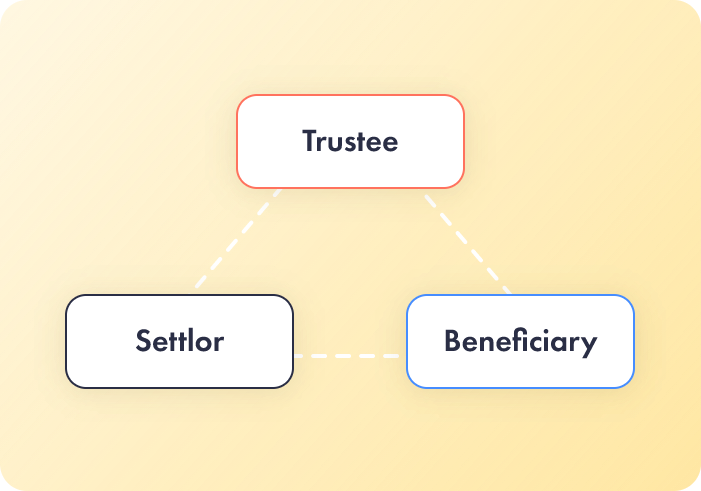

A “trust” is an agreement under which a person (the founder of the trust) transfers property to the manager, which he undertakes to own and dispose of in the interests of specific persons (beneficiaries). The easier way to understand this concept is to refer to a tripartite fiduciary relationship between Settlor, Trustee, and Beneficiary.

A “Trust Agreement” also sometimes referred to as a “Declaration of Trust Management” is an agreement under which one party transfers property to the other party for a certain period of time in trust management, and the other party undertakes to manage this property.

The contract shall specify the composition of the property transferred for management, the name of the legal entity or the name of the citizen in whose interests the property is managed, the amount of remuneration for management if any, and the terms of the contract. The contract must be concluded in writing.

The most common use of such an agreement is to ensure that the trust is protected and administered properly, in accordance with the law and the wishes of the settlor of the trust.

What is an offshore trust?

The trust allows you to legally isolate assets from the owner (legal entity or individual), and thus protect against the risk of loss of assets. An offshore trust is a trust registered in an offshore zone. Its only difference is that it is regulated in accordance with the law of the offshore jurisdiction.

What is the difference between an offshore trust and an onshore trust?

Both of them are very similar: they have the same structure, functions, responsibilities, and types.

The system is the same – the founder creates a trust, the trustee receives trust assets from the founder, manages them for a certain period of time on behalf and in the interests of a third party, and the beneficiary receives benefits from the assets, as well as other Protector (optional). We will talk about all these steps later in this article. Despite the similar structure, there are still differences. In most cases, the trust is not subject to income tax or capital gains tax received from the property of the trust, if it is registered in an offshore jurisdiction. By the way, an onshore trust is subject to compliance with local taxes and court decisions and does not enjoy the benefits of foreign trusts.

An offshore trust protects assets from forced inheritance, divorce, and bankruptcy. An offshore trust is not subject to foreign law.

What is an offshore trust?

The structure of fiduciary relations that we are used to (three-component) becomes unusual for us by adding another component, but this has helped many offshore trusts to streamline their work.

In order to better understand the picture, let’s deal with each participant:

- An offshore trust settlor is one who creates a trust and transfers any assets to it. The founder of an offshore trust can be a legal entity or an individual.

- Trustee - a natural or legal person responsible for the management of the trust, and the implementation of the terms of the trust agreement. In Nevis, the trustee can be either a local trust company or an offshore IBC company.

- The beneficiary is the ultimate beneficiary of the property held in the offshore trust. In a trust agreement, a specific legal or natural person, a class of persons, a class of relatives can be named as a beneficiary. There can be any number of beneficial owners of an offshore trust.

- A protector is a person, a committee, or an entire company. He is appointed to monitor the implementation of the will of the founder and the protection of the interests of the beneficiary.

We encourage you to read our guide

Everything you need to know before setting up an offshore company

Pros and cons of an offshore trust

Confidentiality and anonymity. Despite the fact that an offshore trust is officially registered with a government agency, the parties to the trust, the assets, and the terms of the trust are not recorded in the register.

Tax-free status. Assets that are transferred to an offshore trust (in a tax-free offshore zone) are not taxed either when transferred to a trust, or when transferred or redistributed to beneficiaries.

The ability to transfer assets in a short time and without high costs. Transferring property through an offshore trust does not require formal approval by a judge or high attorney fees.

Asset protection. The trust protects assets from a forced inheritance, withdrawal during divorce, and bankruptcy. An offshore trust is not subject to foreign law.

Capital accumulation. The trust can own commercial enterprises, open bank accounts, participate in international investment projects, and its income will be accumulated in one of the tax-free offshore zones.

Reliability. Your capital will be safe from the financially, politically, and economically unstable world.

Versatility. Any assets can be transferred to a trust – tangible and intangible, for example, real estate, shares and other securities, cash, jewelry, intellectual property rights, art objects, and much more.

Flexibility. An offshore trust can be registered during the life of the founder, or after his death through a will.

A notable feature is that founders can include themselves as beneficiaries, and the list of potential beneficiaries is not limited to close family circles. However, the role and responsibility of the beneficiary should be clearly spelled out in the Treaty.

The disadvantages of an offshore trust include certain costs associated with the transfer of assets to an offshore trust, which is usually higher than for onshore ones.

Also, certain difficulties may arise if you want (as a beneficiary) to repatriate your assets (return to your country of residence).

Best Offshore Trust Jurisdictions.

As we said, offshore trusts are created in offshore jurisdictions with low or no taxation, but the higher the reputation of the jurisdiction, the more reliable your assets and the more benefits your trust can receive.

We have prepared for you a list of jurisdictions, which we recommend that you familiarize yourself with:

- St. Kitts & Nevis;

- St. Vincent & Grenadines;

- Belize;

- Seychelles;

- British Virgin Island;

- Cayman Islands;

- New Zealand;

- Switzerland;

- Liechtenstein;

Are you interested in an offshore trust? WeFormOnline will give you the advice and service you need, every step of the way!

Get in touch

How to choose an offshore trust jurisdiction?

In order to answer this question, you should understand the key selection criteria:

Trust Laws: Review the trust laws in your chosen jurisdiction. The more modern and loyal it is, the better for you, as it will meet your standards. Usually, English law is taken as a basis.

Favorable tax regime: Loyal and favorable treatment of foreign companies is an important selection factor. You should also find out if your company is subject to taxes and what kind.

Political and Economic Stability: A politically and economically stable jurisdiction will keep your assets safe and secure.

Confidentiality: Confidentiality will provide you with an extra layer of protection for your assets, and information, and keep them out of the public eye.

Currency Control: Moving your funds from country to country should be hassle-free and will also give you flexibility for your business.

Have we helped you decide on the protection of trust assets?

An offshore trust is one of the best ways to manage your assets due to its asset protection, privacy, security, and tax benefits. All of the above advantages of an offshore trust make it preferable to an onshore one, However, let’s not ignore certain difficulties that may arise in opening an offshore trust or its operation.

The advantages clearly outweigh its disadvantages, so it is very important for you to choose the right offshore jurisdiction, and remember, we are here to help